Logistics

Warehousing & Fulfillment

Transportation

Industries

Technology & Innovations

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks

[Updated post from May 27, 2021]

If you're reading this blog, you probably already belong to a loyalty program. Today, nearly three-quarters of U.S. adults report being a member of at least one rewards program.

It's easy enough to entice customers to join a program. But actually getting them to participate is another.

The very best loyalty programs nurture customers to adjust their shopping behaviors in exchange for relevant and useful perks. By emphasizing touchpoints that build brand affinity and customer satisfaction, successful loyalty programs make it well worth their customer's while to engage.

But this is far from the norm. In fact, eMarketer found that 64% of loyalty program members don’t redeem rewards more than a few times per year.

Why? Because offering points or occasional discounts is not the same as offering value. Customer loyalty is a fickle beast, and occasionally lobbing a coupon or discount code at your customers isn't going to turn them into brand advocates.

With this in mind, it's hardly surprising that 78.6% of respondents to Antavo's 2023 Loyalty Report said they plan to redesign their loyalty program within the next three years. So, what changes do brands need to transform their loyalty program from surviving to thriving?

In this post, we're going to cover:

A customer loyalty program is a CX strategy that increases retention by giving customers ongoing incentives to make purchases. Common rewards within programs include personalized discounts and offers, free shipping, free product samples, exclusive access to sales, and more.

The purpose of loyalty programs is to build long-term customer relationships that boost key metrics like Average Order Value (AOV) and Customer Lifetime Value (CLV). By encouraging repeat purchases, brands can drive higher revenue growth.

The mechanisms that brands use to encourage further spending and interactions will depend on the type of program they're using. Common loyalty models in retail include:

The goal of a customer loyalty program is simple; to retain customers by persuading them to keep purchasing from their brand, instead of competitors.

Loyalty programs do this by rewarding customers according to how much they engage with a brand. The more they purchase or participate in the community, the more rewards or perks they will earn.

When executed well, loyalty programs perpetuate a feedback loop of escalating brand loyalty. The more that customers spend and redeem, the higher customer satisfaction becomes. This in turn encourages future purchases in pursuit of bigger rewards.

Moreover, loyalty programs are a fantastic source of consumer research. Loyal customers are much more likely to offer customer feedback about the shopping journey and perceived program value, helping brands to refine their program and gain insights about buying habits.

According to Accenture, more than 90% of companies today have some kind of customer loyalty program. This figure reflects consumers' growing interest in loyalty programs. Yotpo's State of Brand Loyalty 2022 survey found that 73.3% of U.S. respondents said they would like to sign up for a loyalty program - up from 68% in 2021.

But the picture isn't all rosy. Other research also reveals a lot of dissatisfaction in how loyalty programs operate:

Despite consumers being more open to joining programs than ever before, many loyalty programs are offering a lackluster experience that fails to drive growth. It's a clear sign that traditional loyalty programs have reached their limit.

There are numerous examples of brands who've failed to meet consumer expectations – sometimes even choosing to shelve their loyalty programs altogether. Target, eBay, and Subway are just a few well-known examples of brands that jettisoned their loyalty programs over the years. While others are struggling to ensure that their programs stay relevant.

So, why do many brands struggle to develop loyalty programs that last?

When programs fail to thrive, it's because the underlying loyalty program strategy doesn't recognize what customers want from the experience. Traditional sales-driven loyalty programs that revolve around discounts and monetary rewards no longer meet consumer expectations for unique customer experiences:

So, why are rewards programs no longer hitting the mark?

The truth is that many brands are operating out of a very outdated playbook. Traditional sales-driven loyalty programs that revolve around discounts and cashback no longer meet modern expectations for unique customer experiences.

When loyalty programs fail to thrive, it's usually because they're structured in a way that prevents them from recognizing the inherent value of their customers.

Loyalty cards were among the earliest programs in retail, and continue to dominate today. After all, nearly all of us least one ‘buy 9 and get your 10th coffee free!” loyalty card sitting on our wallets.

But this approach has a major flaw. Once a customer has redeemed their perk and the clock has reset to zero, they have no incentive to keep providing you with repeat business.

This is what we call the punch card mentality; when customer loyalty programs fail to pull customers into cumulative lifecycles that promote brand loyalty.

Even when programs ditch physical cards in favor of digitization, this frame of mind isn't always left behind by loyalty managers.

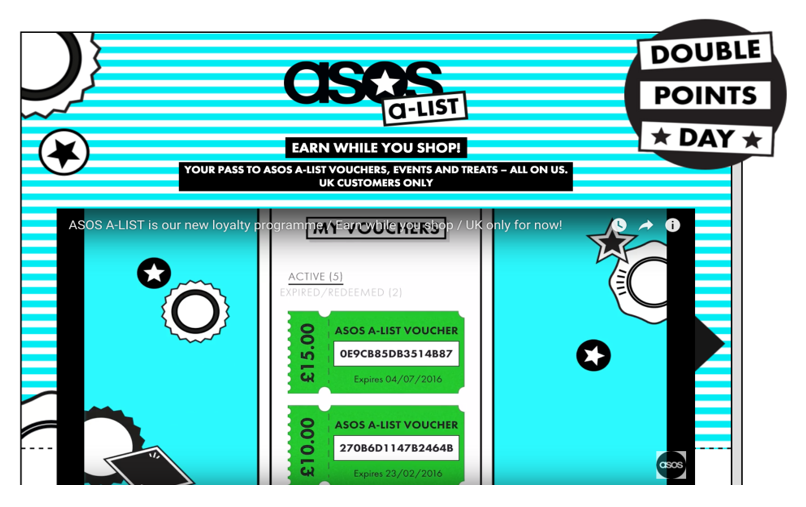

ASOS' A-list rewards program is one such loyalty system that fell foul of this principle. Its loyalty program strategy revolved around customers earning and redeeming points in return for ASOS vouchers, a process that quickly became repetitive. The fast fashion brand chose to pull the plug on the program in 2018, citing ‘a lack of engagement' from the majority of its members.

This is a prime example of how punch card-style loyalty programs encourage ‘earn and burn' shopping behaviors. Both customer and business get little long-term value from these programs, since they don't provide any other perks to keep members engaged.

It's inevitable that retailers sometimes need to rethink their loyalty programs in response to changes in customer behavior. But the internet (especially Twitter) is littered with examples of brands who damaged their reputations by choosing to reward specific behaviors - and leave other customers in the cold.

Starbucks caused controversy in 2016 when it'a new program inadvertently penalized ‘normal' coffee drinkers by favoring their frappucino-ordering counterparts. Where customers had previously earned the same number of ‘stars' per order placed, this was adjusted to offer bigger rewards to those buying expensive beverages. In doing this, Starbucks was accused of neglecting the customer segment who demonstrated brand loyalty through purchase frequency.

This wasn't the first time the coffee giant failed to get customers on board with loyalty program changes. Many loyal customers felt betrayed by their 2019 decision to remove its two-tier loyalty system, which in many ways was a step back from the changes they'd made in 2016 to reward bigger spenders.

From Starbucks' perspective, these changes were logical;. They wanted to lower the cost of maintaining the program and simplify it, allowing members to earn rewards more easily. But the message is clear; making seismic changes to your loyalty program adds friction to the customer experience.

Tiered loyalty programs are popular in retail for a reason. This loyalty model makes it easy to segment customers according to their lifetime value – and reward them accordingly.

But if left unchecked, tiered programs can end up perpetuating a feudal-style system where a minority of customers reap the rewards, while the rest find it too expensive to participate.

A successful loyalty program entices customers to engage through the prospect of gaining access to bigger and better rewards over time. But if loyalty members are offered too few opportunities to earn rewards, or too high a threshold to redeem them, their motivation will plummet.

The result is that higher tiers remain active, and the much larger bottom tier suffers from low customer engagement and repeat purchase rates. According to WireCard, consumers’ top frustrations with loyalty programs are long waits for rewards (46%), a complicated redemption process (34%), and difficulty tracking points (27%).

Moreover, a 2016 analysis of tiered programs found that while earning rewards did encourage the most loyal customers to spend more, it had the opposite effect on customers who struggled to qualify for perks. For those who couldn't access higher membership tiers, loyalty programs hurt the customer experience and resulted in higher levels of customer churn.

In sum, your loyalty program could be counterproductive if only 10% of your customers are able to access useful rewards. If there's no low-hanging fruit to give customers a sense of momentum, they're likely to find another program that will.

If your loyalty program is being driven by customer acquisition, you're missing out on valuable opportunities to drive brand engagement.

In today's omnichannel environment, customers can add value to your business in a myriad of ways. The best loyalty programs are those that recognize that conversions are only one aspect of the customer journey.

All of the touchpoints that lead up to the moment of purchasing – from liking you on social media to signing up to your mailing list – serve to build customer loyalty and provide key insights into the customer experience. By making an effort to reward these interactions with loyalty points or exclusive access to new products, you can foster a much stronger emotional connection with every program member.

In sum, omnichannel loyalty programs allow you to shape behavior in a way that increases customer lifetime value to your brand. It's next-gen influencer marketing – with a lot less hassle.

So, how can loyalty programs be improved to improve the customer experience and retain customers for longer?

Consumers will never join a loyalty program with the intention of not using it, but this is a common outcome. When rewards don't feel exciting or relevant to customers, they're less likely to engage.

Your loyalty program should be designed with one person in mind; your customer – and that customer alone.

By integrating personalization into your loyalty program, customers feel more invested in participating because benefits have been tailored to their habits and preferences, rather than one-size-fits-all rewards.

Example: Target

Target has long been a master of personalized experiences, using robust analysis of customer data to predict what products customers will be interested in buying next.

It's taken this a step further with its Target Circle loyalty program, where customers gain access to tailor-made discounts for the products and categories they're most interested in. This is in addition to perks like early access to events and storewide sales and birthday rewards.

As we explored earlier, programs that only allow customers to learn points or perks through a single transaction are too inflexible to appeal to most consumers.

Furthermore, loyalty managers who turn programs into a numbers game will struggle to forge an emotional connection with customers. If a program is perceived as too ‘difficult' to advance in or doesn't excite customers, they're unlikely to invest in it.

By aligning your loyalty program more closely with your brand values, you can make the experience of participating in your program much more engaging for customers.

Example: North Face

North Face's XPLR Pass program has set a new standard in experiential loyalty programs by incentivizing customers to engage more with the great outdoors – and so putting one of its core brand values into action.

Via their mobile app, customers can accrue loyalty points in unique, on-brand ways, such as by ‘checking in' at national parks or testing North Face apparel out in the field and leaving reviews. The idea of getting outside and exploring underpins the entire program, such as offering customers the opportunity to redeem points on hiking and climbing trips.

The interactive nature of their program gives North Face customers access to a high-value experience that's rewarding in more ways than one.

You shouldn't develop a loyalty program if your brand doesn't have a good grasp of what their customer wants. Why? Because copy-pasting a generic points program or tiered loyalty program from a rival brand is unlikely to strike a chord.

If the earning/redeeming mechanisms of your program aren't aligned with the shopping behaviors of key customer segments, engagement is likely to suffer.

Example: Hugo Boss

Hugo Boss is a great example of a loyalty program that truly understands its customer base. At first glance, it doesn't look like a traditional; loyalty program at all.

At first glance, their loyalty program doesn't appear to offer many incentives to spend. The Hugo Boss Experience is free to sign up for and has no loyalty tiers, allowing all members to access perks such as a free tailoring service, private styling appointments, and door-to-door delivery.

But as a luxury fashion brand whose products sell at a high pricepoint, Hugo Boss understands that their clientele expects these services to be available. This allows them to maintain a high-end image while increasing customer satisfaction.

As apps continue to compete for space on consumers' mobile devices, brands need to offer a competitive value proposition if they want their customers to give them a valuable piece of this real estate. The most compelling offer? Convenience.

By rolling together multiple services within their loyalty program or app, brands can streamline the customer journey and offer more ways to earn and redeem points, boosting the value perception of their program. This has been made easier by growth of strategic retail partnerships with offer mutual benefits.

The beauty industry has been ahead of the curve in enabling shoppers to leverage the benefits of their storefronts and that of their partners to build point balances:

Example: Sephora

Sephora's Beauty Insider program is often considered the gold standard for successful loyalty programs, with the program boasting over 17 million members in North America alone. They recently paired by with DoorDash to offer members a same-day delivery option. Members can link their Insider account with DoorDash in order to earn loyalty points directly through the DoorDash app, as well as access discounts through DoorDash directly.

By linking up with DoorDash, Sephora is doing far more than offering multiple delivery options; they're also promoting their loyalty program in multiple places outside of their own ecosystem.

Many brands worry that consumers will balk at the suggestion of paying extra for additional services. But according to several studies, the opposite is true. Mckinsey found that consumers are 60% more likely to spend money with a brand after joining a paid loyalty program, compared with just 30% at a free loyalty program.

The reason is simple. When a customer has invested money in receiving certain perks, there's a much bigger incentive to make regular use of them. But there's another motivation that speaks to the customer segment attracted to these programs.

If a customer has chosen to invest in a paid program, they'll have given this decision much more consideration than when signing up for a free one. Most likely, they'll crunch the numbers and compare how much they spend with a brand versus the program cost to determine how much value they get. In sum, paid programs will naturally attract your most frequent, high-spending customers - and you can reward them accordingly.

Paid loyalty programs open the door to offering a much broader variety of benefits and experiences that aren't economical under a free system. This includes free shipping, priority access to new products, members-only events, and white glove experiences like unboxings and premium packaging. This enables brands a key competitive differentiator that they won't find elsewhere.

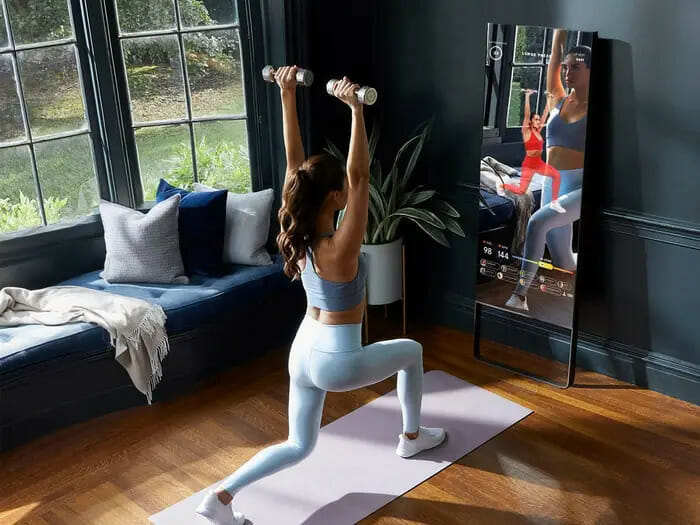

Example: Lululemon

A firm favorite with consumers who enjoy healthy, fashion-forward lifestyle, Lululemon has made the most of its recent acquisition of AR fitness technology Mirror by combining its fitness subscription with a host of other loyalty benefits. This new paid loyalty program costs $39 per month and offers Mirror owners a variety of at-home fitness classes, as well as free in-person Lululemon Studio classes, early access to new products, receipt-free returns, and more.

By bringing together a fitness and loyalty program into one, Lululemon has created a targeted, high-value initiative that other brands in this competitive space will struggle to match.

Moving away from physical loyalty cards to the full digitization of your program is key to increase convenience for consumers. But there's now a new frontier available: The metaverse.

Experiences within these immersive digital spaces offer brands a new way to engage customers and offer rewards. From virtual storefronts to online games and unique collectibles, retailers are experimenting big with the metaverse as part of loyalty initiatives to see what sticks.

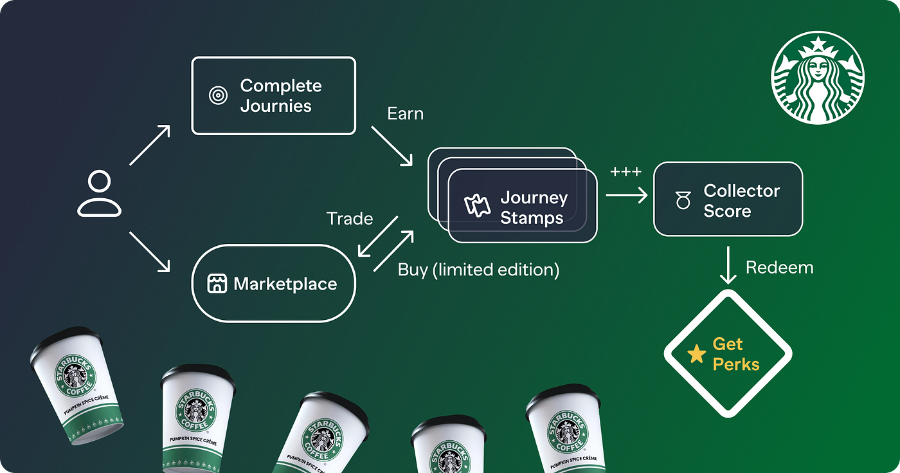

Example: Starbucks

With one of the biggest loyalty program in the food and beverage industry, it's not surprising that Starbucks is looking to innovate and find ways to stay ahead of the pack. Their Starbucks Odyssey experience brings Starbucks fans to a online platform where they can play interactive puzzles and complete challenges to earn NFT collectibles.

Starbucks Odyssey naturally compliments the Starbucks Rewards program and provides new avenues of engagement for die-hard fans, while also adding a new level of exclusivity and ownership through the opportunity to accumulate the rarest and most sought-after rewards.

The change in the wind is clear; consumers want to participate in loyalty programs that offer perks and experiences that enable them to form a deeper connection with brands.

As expectations grow for more diverse perks that embrace omnichannel experiences, the winners are the brands that use redesign loyalty programs to enhance lifetime value. By actively supporting customer desires for personalized offerings and innovative experiences, retailers can gain a serious competitive advantage.