Logistics

Warehousing & Fulfillment

Transportation

Industries

Technology & Innovations

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks

One of the most challenging parts of inventory management is that not every item in your catalog is going to be a winner.

Even with good insight into what customers want, there can still be circumstances outside your control that affect demand for different products. This can result in your business having more inventory on hand than you're unable to sell - the perfect recipe for dead stock.

In this post, we're going to:

By this point, you're probably asking what the term dead stock means.

Dead stock refers to inventory at an ecommerce or physical store that hasn’t sold by the time it reaches the end of its lifecycle, and also has little chance of selling in the future.

Not surprisingly, dead stock is very damaging to a business’s bottom line. If retailers are unable to find willing buyers, they may be forced to put inventory into liquidation and absorb the cost. Despite this, it's estimated that as much as 20-30% of the average retailer's inventory is made up of dead stock.

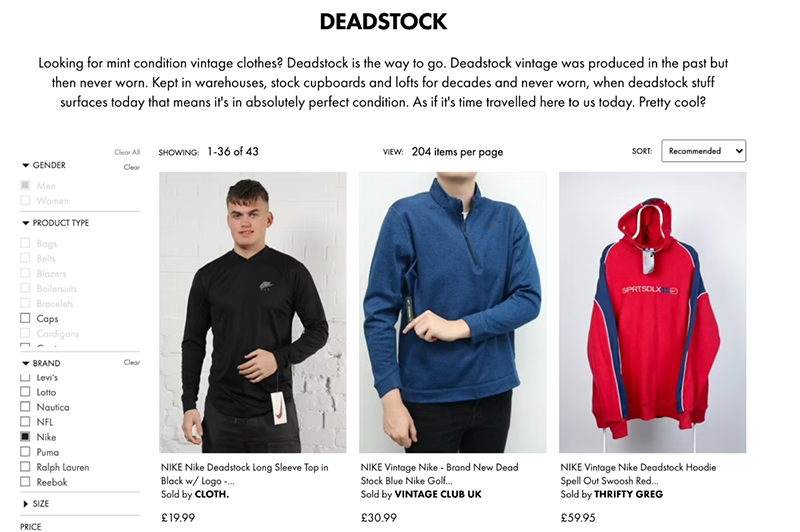

Dead stock inventory should not be confused with deadstock (one word). Deadstock items usually belong to discontinued product lines of high-end brands or represent vintage styles using materials or patterns that are no longer readily available. Unlike obsolete inventory, deadstock is highly valued by collectors and fetches for extremely high prices. Nike deadstock, for example, can be found on a variety of marketplaces including Etsy and ASOS.

The terms ‘dead stock’ and ‘excess inventory’ get used interchangeably because they both involve retailers holding large amounts of inventory. However, they represent very different business outcomes; excess stock is an opportunity, whereas dead stock is a liability.

Put simply, the definition of excess inventory is when supply outstrips customer demand. This results in slow-moving products with expensive holding costs. But if a retail business acts fast, it can prevent excess inventory from becoming dead stock.

Strategies such as hosting clearance sales, product bundling, or diverting inventory to different store locations enable merchants can manage excess inventory effectively and even strengthen their bottom line.

In sum, excess inventory isn’t exclusively bad - unless the business lets that stock sit idle and become obsolete.

Dead stock is pervasive in retail for a simple reason; many retailers don’t want to acknowledge that it’s a problem.

Given the cost of buying the inventory in the first place, especially seasonal items, it can be hard to admit you’ve made the wrong call. It’s easier to hope that those products gathering dust on the shelf will be sold ‘one day’ than to change how you manage your inventory. But the cost of dead stock is far bigger than what's being paid to your supplier.

Space is at a premium when it comes to storing inventory, with warehousing costs currently up 5.59% in 2021 due to the escalating demand for online shopping. According to InsightQuotes’ Warehousing Cost and Pricing Survey, 61% of warehouse operators say they'll be increasing their rates this year.

In sum, the more products you have, the more storage is going to cost you.

If your inventory is made up of fast-moving products with high levels of demand, this isn’t necessarily a problem. But if a high percentage of your inventory is dead stock, you’re wasting valuable warehouse space. This is compounded by the fact that storage costs come bundled with other expenses, including insurance, labor, handling, and warehouse utilities.

There are also opportunity costs that are difficult to quantify but are no less damaging to your business.

For example, choosing to discount dead stock or sell it via Amazon and eBay may help to shift product, but this has ramifications beyond reducing your profit margins. Continuous discounts can devalue your brand and attract shoppers who are less brand loyal and more interested in getting a good deal. Once you’ve set these expectations amongst shoppers, it’s very difficult to change them.

But to tackle the issue of dead stock, we first need to understand why it happens in the first place.

There are a variety of reasons why retailers may find themselves stuck with obsolete inventory. This is usually due to poor sales and inventory control that make it difficult for merchants to keep track of inventory and make accurate forecasts. Unless these problems are addressed, merchants can become stuck in a downward spiral of accumulating inventory that impacts their profitability.

Anyone who has worked in retail will have experienced the joy of finding long-forgotten SKUs pushed to the back of warehouse shelves. In many cases, it isn’t possible to find out what collection or cycle that inventory came from; without a real-time inventory management system, keeping on top of your inventory levels is a herculean task. Unsold inventory simply sits in the dark corners of warehouses or storerooms because retailers don’t know where it is or how many units there are, resulting in dead stock that goes unnoticed until it’s too late.

Demand forecasting is one of the most important parts of being a successful retailer. If you don’t have the data to predict which products are going to be popular, it’s impossible to know how many units you need. This leaves merchants in a tricky position; order too few and missing out on sales, or order excess and risk ending up with dead stock further down the line.

Many merchants end up choosing the latter option because they can save money per unit by placing larger orders with suppliers. But while these cost savings are attractive, they can easily end up disappearing if stock becomes too difficult to sell.

Even with the very best forecasting methods, there can be external influences that disrupt demand and leave retailers with more inventory than they bargained for. For example, the sales of tailored pants and jackets dropped dramatically during 2020 as a result of work from home practices. After all, consumers are hardly going to spend big on clothing items that no one is going to see.

Anything from an extreme weather event to the pandemic can lead to whole product categories no longer being attractive to consumers, which causes the likelihood of dead stock to increase.

As a result of the COVID-19 pandemic and continuing supply chain disruption, we’ve seen retailers take a more conservative approach to inventory management. Where merchants previously used a JIT (Just-in-Time) model to source inventory at very low reorder points, JIC (Just-in-Case) logistics has become the new industry standard out of necessity.

In a JIC approach, businesses deliberately keep large supplies of inventory on hand as insurance to avoid adverse circumstances, such as selling out of stock and facing difficulties in getting resupplied quickly.

JIC offers retailers the advantage of maximizing sales opportunities and being much more resilient to supply chain shocks. However, this also means a much higher risk of inventory turning into dead stock.

If you’re going to keep larger quantities of SKUs, you need to have several strategies for how you’re going to keep this inventory moving. This includes marketing, storage, and store displays to drive interest. Otherwise, excess inventory will quickly become dead stock.

But if a large amount of capital is tied up in inventory, retailers are understandably reluctant to write it off and create cash flow issues. This leads to stock that languishes on shelves because ‘just in case’ has become a barrier to flexible inventory management.

SKU proliferation is one of the biggest causes of dead stock. It’s easy to say that ‘bigger is better’ when it comes to your product offerings, but more SKUs mean more inventory to manage. If you’re adding new products or variations to your online store based on gut feeling rather than hard data, you could end up splitting sales between different offerings and inadvertently creating dead stock.

Let’s say you were offering a dress that comes in three different colors. Due to the high demand for the style, you decide to add additional colors to the range. But if you don’t adjust the number of units you’re ordering for each color variation, you can easily end up with more stock than you need - and face difficulties as demand wanes.

There are plenty of strategies to alleviate the impact of dead stock, such as discounting, donating products to charity to claim a tax write-off, or reappropriating it as giveaways or free gifts. But the best way for retailers to deal with dead stock is by putting measures in place to stop them from accumulating it.

None of these strategies can be put in place overnight, but they pay for themselves several times over in the long run by reducing the likelihood of dead stock at your retail business:

By far the easiest way to combat dead stock is by investing in inventory management software that enables you to track inventory in real-time and alert you when certain SKUs are at risk of becoming excess inventory. This allows you to be proactive in changing your marketing strategy to increase its appeal and shift products more effectively. Moreover, dashboards make it easier to identify recurring trends in what products are slow-moving, such as issues with product specifications from certain suppliers.

While JIC logistics models are a sensible strategy in the current environment, this isn't appropriate for every product offering. Seasonal items bought in for the holiday season, for instance, have a very small window to be sold before they become dead stock. Trying to buy a surplus of every SKU is a recipe for a whole lot of dead stock.

Instead, it's important to be strategic about which products are worth the larger inventory supply. Backordering and scarcity marketing is a powerful tactic to drive consumer demand, meaning that smaller inventory accounts can actually be an asset rather than a disadvantage. While there is the risk that you might lose out on some sales, the cost of dead stock is certainly going to affect your profitability more.

Every retailer should be undertaking regular audits of their SKUs to make sure that all of the products they're selling are actually profitable. It's very easy for your SKU base to grow out of control during busy times of the year, which makes inventory management much more difficult and time-consuming.

SKU rationalization allows for better inventory accuracy and tracking and helps you to avoid product cannibalization at your store i.e. introducing a new product that's similar to an existing one. You should weigh up factors such as storage costs, return rates, inventory turnover, and lead times to help you determine whether or not a product is worth keeping on the shelves.

If you don't know what your customers want, dead stock is a very likely outcome. Understanding what customers like and dislike is the key to selecting products that you'll struggle to keep on the shelves (at the end of the day, it's a very good problem to have).

Encourage your customers to leave reviews on your products pages or to answer surveys to if there's anything else they would be like to be able to purchase from you. This gives you the advantage of being on the pulse of consumer trends, while also showing customers that you genuinely care about their shopping experience.

Dead stock is a challenge that retailers large and small have to navigate. How you choose to address it is the difference between dead stock becoming an institutional problem or something you're able to keep in check with effective mitigation strategies. By identifying the causes of dead stock at your business and the right steps to address it, you can increase profitability and reinvest the money you're losing from dead inventory into bigger growth opportunities.