Logistics

Warehousing & Fulfillment

Transportation

Industries

Technology & Innovations

E-commerce

E-commerce Fulfillment Services

Lease & Maintenance

Semi Trucks

Logistics

E-commerce

Lease & Maintenance

Buy Used Trucks

[Updated post from September 20, 2022]

With the 2023 peak season right around the corner, retailers are gearing up for the busiest period of the year. One of your biggest considerations for the holiday season? Understanding how peak season surcharges are going to affect your shipping costs.

Peak season can be a blessing and a curse for retailers. High order volumes mean more revenue - but this also means that peak surcharges are more likely to affect your bottom line.

So, it's hardly surprising that "How do I avoid demand surcharges?" is a frequent question from shippers at this time of year. But it's important to note that avoiding demand surcharges completely is unrealistic - and that trying can even cause more harm than good.

In this guide, we're going to give you the full rundown on peak season surcharges for 2023 from the major parcel carriers, along with some pearls of wisdom from our very own parcel expert about managing surcharges effectively. Let's dive in!

Peak season surcharges, also known as demand surcharges, refer to temporary surcharges that parcel carriers apply to their base shipping rates to cover increased operating costs during periods of high demand. Most surcharges take the form of flat fees applied per package. A peak surcharge may apply for a fixed period, or until further notice.

Shipping companies usually announce their peak surcharges in September and October, ahead of when parcel volumes start to increase ahead of the holiday season. Demand surcharges are based on a range of factors that make shipping and delivery more complex or expensive for carriers, such as package weight or packages that require additional handling.

A peak season surcharge should not be confused with a General Rate Increase, which recognizes a longer-term growth in operational costs within the shipping industry.

Traditionally, GRIs are applied at the beginning of each year and stay in place until a review of freight charges the following year. Peak surcharges relate to variable increases applied to specific service levels or characteristics for a defined period, such as the holiday shipping season.

However, the line between GRIs and peak demand surcharges has become blurred in recent years. With parcel carriers and supply chains under sustained pressure due to the growing popularity of residential delivery, it's become less clear what qualifies as the ‘peak' – if it even exists at all.

As the holiday shipping season becomes more spread out, the question ‘What is peak season?' no longer has a straightforward answer.

Traditionally, peak shipping season would ramp up throughout October and November with Black Friday and Cyber Monday promotions before ‘peaking' during December. However, higher inflation and lower consumer spending post-COVID have caused many retailers to rely more heavily on retail events to shift inventory, resulting in higher shipping volumes much earlier in the year.

UPS and FedEx caused a stir when they decided to add surcharges to U.S. domestic packages in June 2020, thanks to experiencing peak holiday volumes in the middle of the year. At the time, FedEx referred to these changes as the ‘new normal' to manage sustained demand for e-commerce orders.

In sum, parcel carriers are now implementing surcharges much earlier than they did in the past – and leaving them in place for longer.

In recognition of the fact (and criticism) that peak season surcharges no longer apply exclusively to the holiday season, major carriers are rebranding peak surcharges to 'demand surcharges'. This more accurate term describes how surcharges are increasingly used as a form of surge pricing during busy periods. For example, this latest round of demand surcharges comes into effect over the traditional holiday period, but immediately kicks in following another round of surcharges for most carriers.

Just like last year, customers with high parcel volumes are going to be hit the hardest by demand surcharges. Carriers are calculating residential delivery charges based on how many more packages a customer is shipping above their usual baseline. This is known as the 'peaking factor' and is measured as a percentage over the baseline. The higher the peaking factor, the more shippers will have to pay per package to ship.

With a longer, more spread-out holiday peak becoming the norm, some parcel carriers have begun splitting demand surcharges into different tiers based on date ranges. For example, FedEx is charging $1 more per package on parcels sent between Nov. 27, 2023, and Dec. 10, 2023, when holiday shipments are at their highest. In sum, shippers will be paying a premium to ship during the so-called ‘peak of the peak'.

With surcharges looming or already in effect, how should businesses respond? We spoke to Sean Kim, Vice President of E-Commerce Experience & Global Parcel Strategy at Ryder, to understand what shippers can do to lessen the impact of peak season surcharges in 2023:

"It's not unusual for shippers to try and split volume between different carriers during the holidays, to avoid volume-based residential delivery charges." Says Kim. "This seems logical because the more you ship, the bigger the surcharge. However, the flip side is that less volume with a carrier equals fewer discounts overall."

Carrier pricing often leaves shippers between a rock and a hard place during the holidays. Parcel carriers reward high-volume shippers with bigger discounts due to the amount of business they provide. But during peak season, this higher volume leaves shippers liable for bigger demand surcharges.

"By carrier switching during peak, there's a big risk that all but the very largest shippers will lose volume-based discounts, while still getting stung by demand surcharges." Says Kim. "It's important for shippers to think carefully about switching, especially when surcharges with some carriers can fluctuate weekly. It's all about striking a balance between carriers, volume, and surcharges."

"Peak planning is all about ensuring that parcel carriers have the right capacity during peak." Says Kim. "If a carrier isn't able to service a particular customer, they need to know this ahead of time so they can make other arrangements. If this is left to the last minute, shippers may find themselves struggling to meet customer expectations for rapid delivery."

This is why it's so important for shippers to accurately forecast their expected order volumes during the holidays, and to work closely with their parcel carrier to determine how this will affect services. If you also partner with a 3PL, peak planning should be taking place on an annual basis.

"At Ryder, we work with all of our customers early on in the year to determine what their forecast order volumes are, and how this will impact carrier selection and capacity for peak. This ensures that everyone is on the same page and there is plenty of time to prepare an appropriate shipping strategy."

Demand surcharges and accessorial surcharges are conflated in discussions about peak season, but address different operational challenges faced by carriers.

Unlike demand surcharges, accessorial charges cover scenarios where parcels cannot be processed automatically and require manual attention. This includes oversize packages, extra equipment, or any form of additional handling.

"The main difference for the shipper that is demand surcharges are volume-based, while accessorial surcharges apply to any package regardless of volume or destination." Says Kim. "Demand surcharges are billed upfront, but an oversize or additional handling surcharge will get billed after the fact, which can come as a nasty surprise to shippers."

Because accessorial charges are often unexpected, this can make it difficult for shippers to account for them in their budgets. Tactics like closely monitoring package dimensions and choosing boxes over poly mailers (which are more at risk of getting stuck in sortation machines and triggering an additional handling charge) help to reduce the number of accessorial charges.

Another upside to working with a 3PL during the holidays is that a provider can help shippers identify where charges are coming from and come up with strategies to mitigate them:

"At Ryder, we quantify exactly how many and which packages had accessorial charges applied, down to the individual tracking numbers." Says Kim. "This allows us to work with customers to understand what shipment characteristics are causing problems and how to remedy them."

A notable feature of demand surcharges is that they apply to residential deliveries. This means there is one simple way to avoid demand surcharges; shipping customer orders to commercial addresses.

"Parcel carriers heavily target residential deliveries during peak season, since this is an operationally inefficient and expensive delivery option." Says Kim. "Boosting the number of orders that are shipped to commercial addresses is an obvious way to reduce shipping costs during the holidays."

Of course, this doesn't mean that businesses can dispense with home delivery completely. Consumers often want holiday gifts to be shipped to their home or the recipient out of convenience. However, there are ways you can incentivize customers to ship packages to their workplace or another pick-up point, such as offering cheaper or free shipping for non-residential delivery.

Without any further ado, let's dive into the surcharge schedules for UPS, FedEx, Amazon, and USPS.

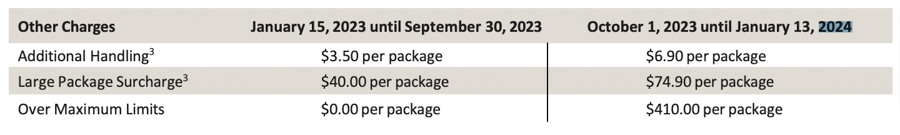

UPS peak surcharges for 2023 are primarily focused on targeting oversize packages and additional handling. The carrier's oversize charge for packages over the maximum limit is $410, the same as FedEx.

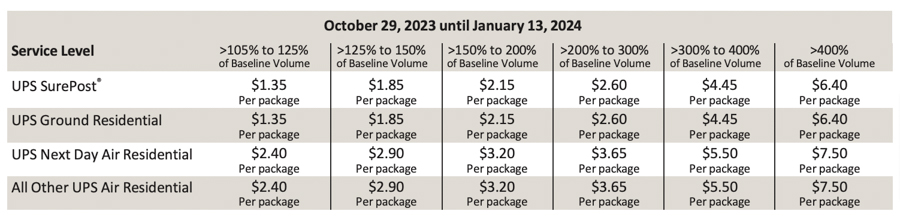

While an additional handling surcharge and oversize charges apply to all U.S. domestic, U.S. import, and U.S. export shipments, an additional residential delivery charge will apply to higher-volume shippers using UPS SurePost, UPS Ground Residential, UPS Next Day Air Residential, or All Other UPS Air Residential:

However, UPS customers should note that UPS surcharges kick in earlier than other parcel carriers, starting from October 1st, though they do come to an end at roughly the same time.

You can find more information in UPS' Demand Surcharges Guide on their website.

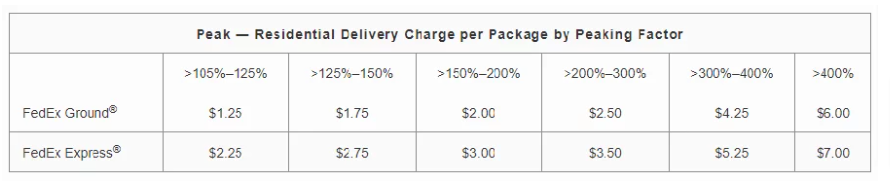

Demand surcharges apply to any FedEx ground economy packages shipped during peak. which spans from Oct. 30 - Jan 14, 2024. The surcharge rate varies based on the date of shipment, with packages shipped between Nov. 27, 2023 – Dec. 10, 2023, experiencing the highest demand surcharge at $2.60 per package. This is an effort on behalf of FedEx to encourage customers to ship parcels outside of the so-called 'peak of the peak':

Meanwhile, FedEx is continuing to crack down on additional handling and oversize packages, with oversized parcels shipped using U.S. Express Package Services, U.S. Ground Services, or International Ground Services charged at $73 per package, while their Ground Unauthorized Package Charge is an eye-watering $410 per package, up from $385 in 2022.

FedEx is also introducing dynamic pricing for its Demand - Residential Delivery Charge based on the number of packages that are shipped during peak season, starting the week of Oct. 9th. The size of the Residential Delivery Charge will depend on the peaking factor by which residential shipping volume exceeds a weekly volume of 20,000 residential packages, as expressed on the peaking factor chart below.

Note that this is a lower benchmark than the 25,000 residential packages used in 2022, meaning that demand surcharges for residential delivery are going to hit smaller shippers this year:

For more information on how the Demand - Residential Delivery Charge is calculated, check FedEx's website.

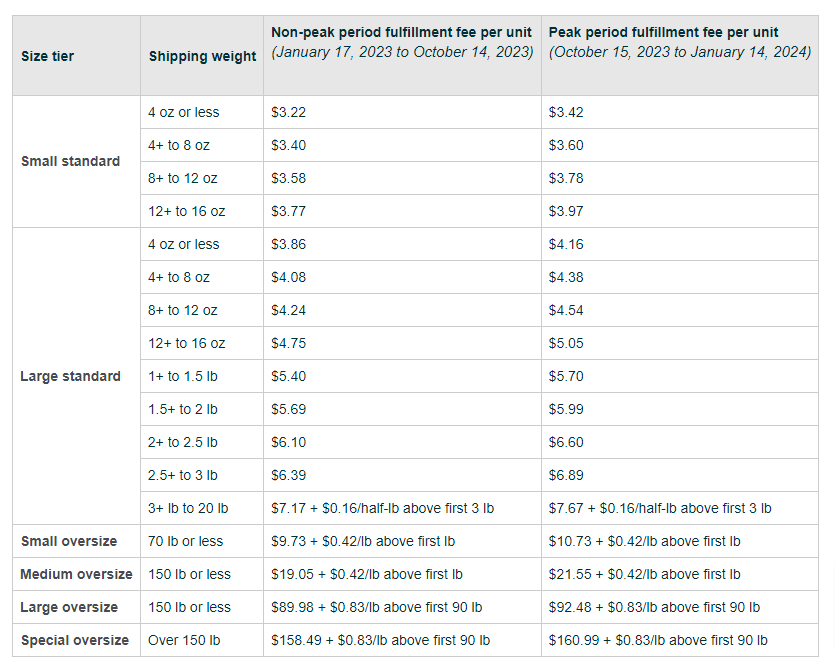

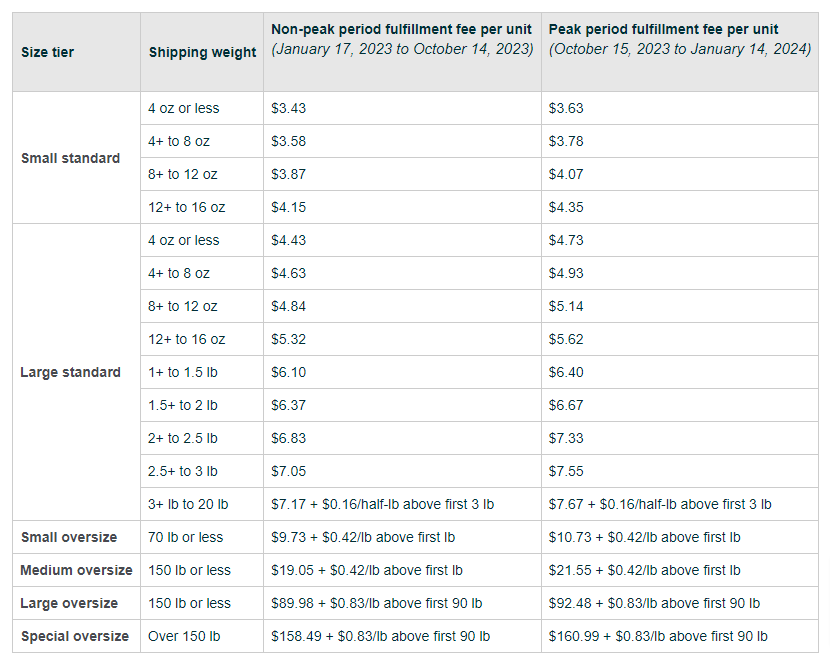

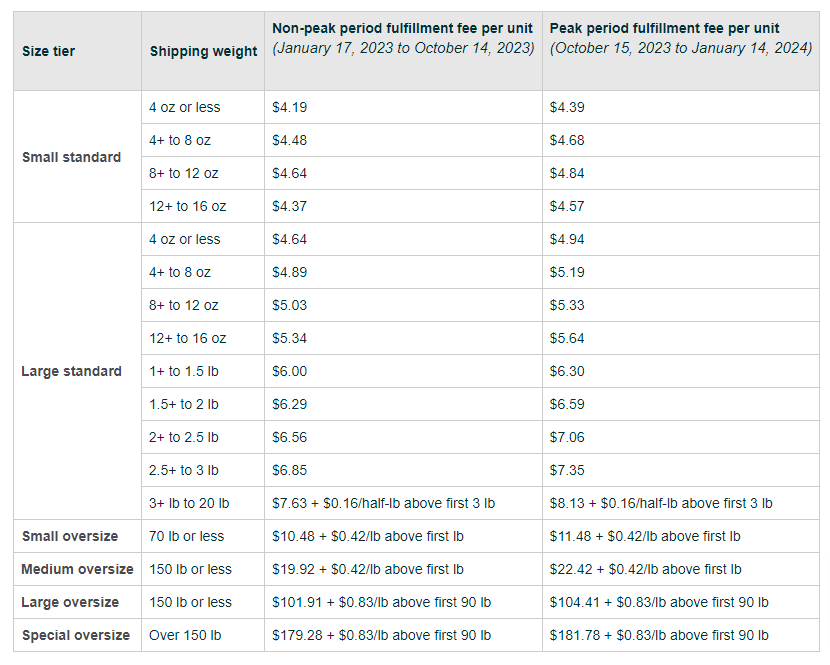

Amazon introduced Holiday Peak Fulfillment Fees in 2022, citing growing seasonal fulfillment costs such as labor and fuel making surcharges necessary to maintain service standards during peak season.

These peak surcharges will be in effect from Oct. 15, 2023, to Jan. 14, 2024, and will apply to all Amazon FBA shipments shipped after Oct 15. These demand surcharges span from $0.20 per package up to $2.50 per package for oversize packages. Amazon is splitting these demand surcharges into three categories:

Peak season surcharges for 2023 are every bit of comprehensive as previous years, with complex calculations, fluctuating volume thresholds, and plenty of fine print.

This is why it's highly advantageous to partner with an experienced e-commerce fulfillment provider like Ryder, which can help your business build a flexible, cost-effective shipping strategy that skillfully navigates accessorial and demand charges. In addition to boasting a highly knowledgeable parcel team, Ryder's advanced tech stack gives real-time visibility over parcel rates, as well as intelligent shipping method selection via our automated SmartRate Selection tool. No matter whether you are a direct-to-consumer or wholesale brand, Ryder can develop the perfect shipping strategy for your needs during the holiday season and beyond.