Customer expectations have never been higher—and they don’t end when a product is delivered. New data from AfterShip shows that if merchants want to retain more revenue from returns, they need to think beyond the traditional refund model.

Returns are a huge headache for e-commerce brands. According to a report from the National Retail Foundation, the retail industry saw $743 billion in returned merchandise in 2023—14.5% of total sales. E-commerce merchants saw a higher return rate than brick-and-mortar stores, at more than 17.6% vs 10%. And nearly 50% of in-store returns originated as an online purchase.

Aside from profit loss, returns are a drain on resources, from customer support to logistics teams. The current rate of returns just isn’t sustainable for merchants in the long term, unless they find a way to recapture revenue. And the best way to do that is by offering flexible return options.

What customers want from the returns experience

AfterShip surveyed consumers in 2022 about returns, and the factors they highlighted as most important were speed, trust, cost, and convenience. No surprises there.

What was surprising is that more shoppers—nearly 60%—said they’d recently chosen exchanges over refunds. This highlights the need for fast, frictionless, and flexible return options.

Flexible returns by the numbers

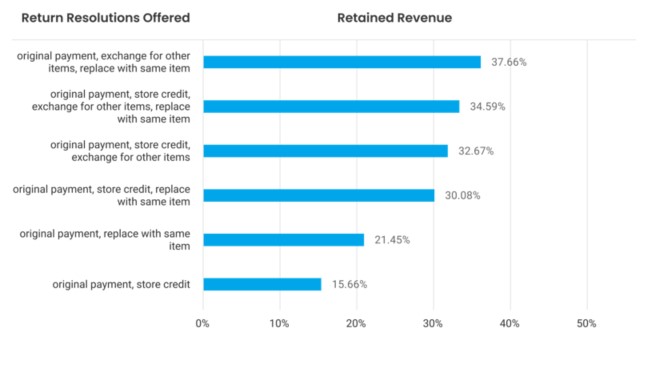

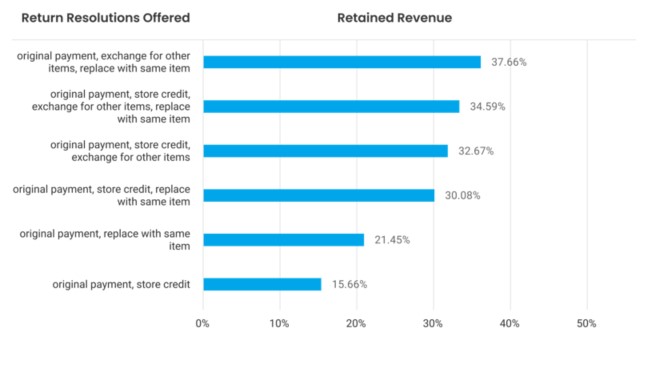

Customers want options when it comes to returns, and merchants who offer flexibility see more retained revenue.

Here are some of the most common return options:

- Refund to original payment: An item is returned and the customer is issued a refund to their payment method at the time of purchase.

- Refund to store credit: An item is returned and the customer receives the value of their purchase in the form of store credit.

- Replace with the same item: A customer exchanges an item for a variant of the original item purchased at the same price point, like a different size or color.

- Exchange for other items: A customer returns an item and exchanges it for another item in the store, often at a different price point.

- Incentivized exchanges: A merchant offers bonus incentives to encourage customers to exchange rather than seek a refund, such as discounts, free shipping, or extra store credit on top of the original item value.

- In-store returns: A customer returns an item bought online in a brick-and-mortar store.

- Green returns: A merchant refunds a customer without receiving the item back. This may be done when an item is damaged, costs less than processing a return, or is unable to be resold for another reason.

- Partial returns for bundles: A merchant issues a refund when a customer returns an individual item purchased as a part of a bundle. This eliminates the need to issue full-bundle refunds.

During 2023’s peak season—a time when brands see a huge spike in both sales and returns—retailers who enabled three or more return options had a revenue retention rate of more than 30%.

The top three returns resolutions had something in common—they all included exchanges for other items. While some customers simply want to replace a purchase with the same product, many also want to find something else that better suits their needs.

There’s no one-size-fits-all approach to which returns options to offer. Customers shopping at apparel brands have different returns patterns than those buying electronics, for example. But the data clearly shows that more is better.

Think of flexible exchanges as an upsell tactic

When merchants offer exchanges for other items, they have a unique opportunity not just to retain revenue, but to increase it. Highlighting bestselling and similar products at a higher price point throughout the returns process gives merchants a chance to upsell, and gives customers an easier way to find the right product.

Merchants who offered exchanges for other items saw an average of nearly 12% in increased upsell revenue during last year’s holiday shopping season.

Automation makes flexible exchanges easier

Exchanges require more resources than traditional returns, but leveraging automation can help to close the gap. For example, merchants that used auto-approval during peak season experienced a 100% reduction in the time taken to process returns, and those who used auto-mark as received saw an average reduction of more than three days—or 31% decrease—in the time taken to process the returns.

Returns automation is a win-win for merchants and customers alike: less hands-on time spent processing the return, and a shorter wait for the right product to be delivered.

How a men’s shoe brand transformed the returns experience

A men’s shoe brand was eager to streamline their returns process and recapture more revenue. When customers wanted to do an exchange, they had to type it out into a note field and submit it as a request. Then they would have to wait and see if the item they wanted was in stock. It created a lot of manual work for the merchant, and a frustrating experience for the customer.

By leveraging AfterShip Returns, they were able to automate many steps in the process, and offer exchanges for other items. Before adding the exchange feature, 75% of their returns turned into refunds, with only 25% turning into an exchange. Now, roughly 50% of their returns are exchanges.

Turn returns into new opportunities

Returns will always be a challenge for e-commerce merchants, but offering flexible options and minimizing pain points can help turn unhappy shoppers into loyal customers.

AfterShip Returns helps merchants deliver a positive returns and exchange experience, optimize return costs, and retain more revenue. The AfterShip and Ryder E-commerce integration makes it easy to coordinate and automate reverse logistics, link RMAs, keep internal teams on the same page, and accelerate return receipt and restock.